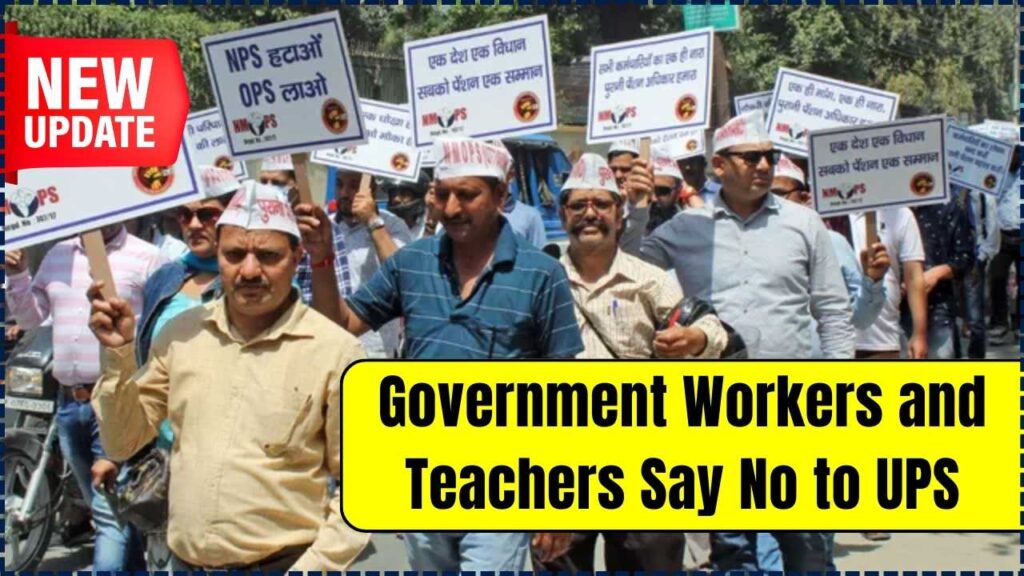

Government Workers and Teachers Say No to Unified Pension Scheme: A growing wave of protests has emerged as government workers and teachers across India reject the new Unified Pension Scheme (UPS), calling for the reinstatement of the Old Pension Scheme (OPS). Employees argue that the UPS imposes financial uncertainties, increased contributions, and lack of inflation protection, making it an unattractive alternative to the OPS.

With widespread discontent, employee unions and federations have mobilized to demand that the government reconsider its stance on pension reforms. Below, we break down the reasons behind the opposition and analyze the implications for public sector employees.

Government Workers and Teachers Say No to Unified Pension Scheme

| Feature | Unified Pension Scheme (UPS) | Old Pension Scheme (OPS) |

|---|---|---|

| Nature of Scheme | Contributory (Employee + Govt.) | Non-contributory (Govt. funded) |

| Pension Calculation | Market-linked, variable returns | Fixed, inflation-indexed pension |

| Inflation Protection | No guarantee of DA or inflation indexing | DA and pension revised regularly |

| Minimum Service Requirement | 25 years | 20 years |

| Market Risks | Yes, depends on investments | No risk, fixed pension |

| Employee Contribution | Mandatory deductions | No contributions required |

| Government Response | Yet to reconsider | Strong push from unions |

| Official Source | pfrda.org.in | N/A |

The Unified Pension Scheme (UPS) has faced severe criticism from government employees and teachers due to its market dependency, lack of inflation protection, and contribution-based deductions. The demand to reinstate OPS is gaining momentum, with protests and union pressure forcing the government to reconsider its stance.

While the government has introduced UPS to reduce financial burdens, employees argue that long-term retirement security should not be compromised. The final decision will depend on political negotiations, economic feasibility, and public demand.

What is the Unified Pension Scheme?

The Unified Pension Scheme (UPS) is a newly introduced retirement benefit program that replaces the Old Pension Scheme (OPS) for government employees. Unlike OPS, which was fully government-funded, the UPS is a contributory scheme where both employees and the government contribute toward a pension fund. The final pension amount is market-linked, meaning retirees may not receive a fixed sum, as it depends on investment performance.

Why Was the Unified Pension Scheme Introduced?

The government introduced the UPS to reduce the long-term fiscal burden of pensions on the treasury. The OPS required the government to pay lifelong pensions, which critics argue was financially unsustainable. By transitioning to a contributory model, the government aims to create a self-sustaining pension system similar to the National Pension System (NPS).

However, employees argue that this shift places an unfair financial burden on them, while removing the assurance of a guaranteed pension after retirement.

Why Are Government Workers Opposing the Unified Pension Scheme?

1. Contribution-Based Model Reduces Take-Home Salary

Under the UPS, employees must contribute a fixed percentage of their salary toward their pension fund, in addition to the government’s share. This reduces their disposable income during their service period, making it harder for them to manage current expenses.

2. Market Risks and Uncertain Pension Payouts

Unlike the fixed pension under OPS, the UPS depends on the stock market and investment returns. Employees fear that poor market performance will significantly reduce their post-retirement income, making their financial future uncertain.

3. No Inflation Protection or Guaranteed Dearness Allowance (DA)

One of the biggest benefits of OPS was automatic inflation adjustments through DA increases. The UPS does not guarantee such adjustments, which means retirees could lose purchasing power over time.

4. Higher Minimum Service Requirement

Under the OPS, employees qualified for a pension after 20 years of service. In the UPS, they must serve at least 25 years to receive full benefits, which affects employees who enter government service later in life.

5. Lack of Clarity on Lump Sum Payments

Under the UPS, a portion of the retirement fund is paid as a lump sum, while the rest is used to provide monthly pension payouts. Employees fear they may not receive the full benefits of their contributions, creating uncertainty.

6. Call for Restoring the Old Pension Scheme

Employee unions argue that the OPS provided long-term stability without subjecting retirees to market fluctuations. With rising inflation, they want a return to a pension system that ensures financial security for all government workers and teachers.

How Are Employees Protesting Against UPS?

Nationwide Protests and Strikes

- State government employees, teachers, and railway workers have staged protests demanding the reinstatement of OPS.

- Organizations like All India Government Employees Federation (AIGEF) and All India Teachers’ Federation (AITF) have launched state-wide strikes.

Union Demands and Negotiations

- Employees want an immediate rollback of UPS and restoration of OPS.

- Negotiations with the government have been ongoing, but no resolution has been reached yet.

- Some states like Rajasthan and Chhattisgarh have already reinstated OPS for their employees, pressuring the central government to follow suit.

India Post GDS 3rd Merit List (OUT?)- Download III Supplementary Selection List Pdf File

H-1B & L-1 Visa Holders in Danger as Trump Eyes End to Auto-Renewal – What This Means for Indians!

Easier H-1B Visa for Indians? Check Out the New US Rules Now!

What Could Happen Next?

While the government has yet to make any decisions, the continued protests and pressure from unions could lead to:

- Reforms in the UPS to address employees’ concerns (such as inflation protection and guaranteed payouts).

- Partial restoration of OPS for certain employee groups.

- Further negotiations between the government and employee unions.

The outcome will depend on the political and economic implications of the pension scheme. If the government fails to address these concerns, future elections may see political parties promising a return to OPS to gain voter support.

FAQs On Government Workers and Teachers Say No to Unified Pension Scheme

Q1: Is the Unified Pension Scheme compulsory for all government employees?

Yes, for new employees joining after the scheme’s implementation, UPS is mandatory.

Q2: Can existing employees opt out of the UPS?

No, employees who joined under UPS cannot switch back to OPS unless the government changes the rules.

Q3: How does the UPS affect teachers and education sector employees?

Teachers and education employees under UPS will face the same market risks and contribution-based deductions, making their financial security less predictable than OPS retirees.

Q4: Have any states reversed the Unified Pension Scheme?

Yes, Rajasthan, Chhattisgarh, and Jharkhand have reinstated OPS for state employees, putting pressure on the central government.

Q5: Is there any possibility that the government will reinstate OPS?

It remains uncertain, but with increasing protests, the government may introduce reforms to make UPS more attractive.